Import CCH iFirm Contact Data into a New Return

You can reduce your tax return preparation time by importing contact information from CCH iFirm into new returns.

ATX requires an SSN or EIN to sync with CCH iFirm’s contact database. If you create contacts in CCH iFirm, be sure to enter the SSN or EIN before importing into ATX. If you create an ATX return for a CCH iFirm contact that does not have an assigned SSN or EIN, the system assumes that this is a "new contact" and a duplicate contact is created in CCH iFirm.

To import contact information from CCH iFirm:

- In Return Manager, click New to create a return.

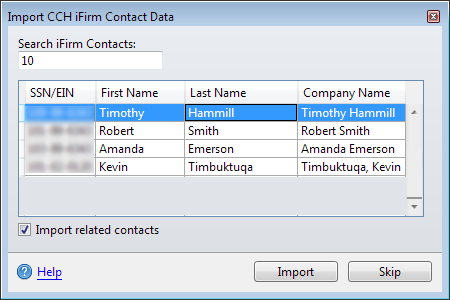

- After selecting forms, the Import CCH iFirm Contact Data dialog displays.

- In the Search iFirm Contacts box, type all or part of the information to display a list of contacts from CCH iFirm. You can search on any of the column heading types (SSN/EIN, First Name, Last Name, or Company Name). ATX displays a list of results.

Import CCH iFirm Contact Data dialog box

If there are no matching contacts, ATX displays a message, No matching contacts found. Verify the information and retype or click Skip.

- Select the contact from the list and click the Import related contact check box, then click Import.

By checking the Import related contacts check box, ATX imports spouse and/or dependent information from CCH iFirm for individual returns. For business returns ATX imports partner, beneficiary, and/or shareholder contact data.

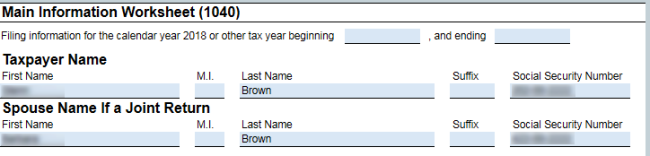

- The Import dialog closes and the selected contact data is entered in your new return.

Import Contact Information

See Also:

Sync New ATX Contacts with CCH iFirm